Gold holds a special place in Indian culture, whether as a symbol of wealth, a safe investment, or an integral part of traditional celebrations. As a result, staying updated on gold prices is crucial for many Indians, especially those planning to buy, sell, or invest in gold. Here’s a guide to understanding how to check gold prices in India effectively.

- Understanding Gold Prices in India

Gold prices in India are influenced by multiple factors:

International Market Trends: The global price of gold, determined by trading on international exchanges, impacts Indian rates.

Currency Exchange Rates: The Indian rupee’s value against the US dollar affects import costs, influencing gold prices.

Local Demand and Supply: Festivals, weddings, and seasonal demand can push prices higher.

Government Policies: Import duties, GST, and other taxes can also affect the final price.

Gold prices vary between 22-karat (used in jewelry) and 24-karat (pure gold) gold, so always ensure you’re comparing the right variant.

- Reliable Sources to Check Gold Prices

Here are some trusted ways to stay updated:

a) Online Portals

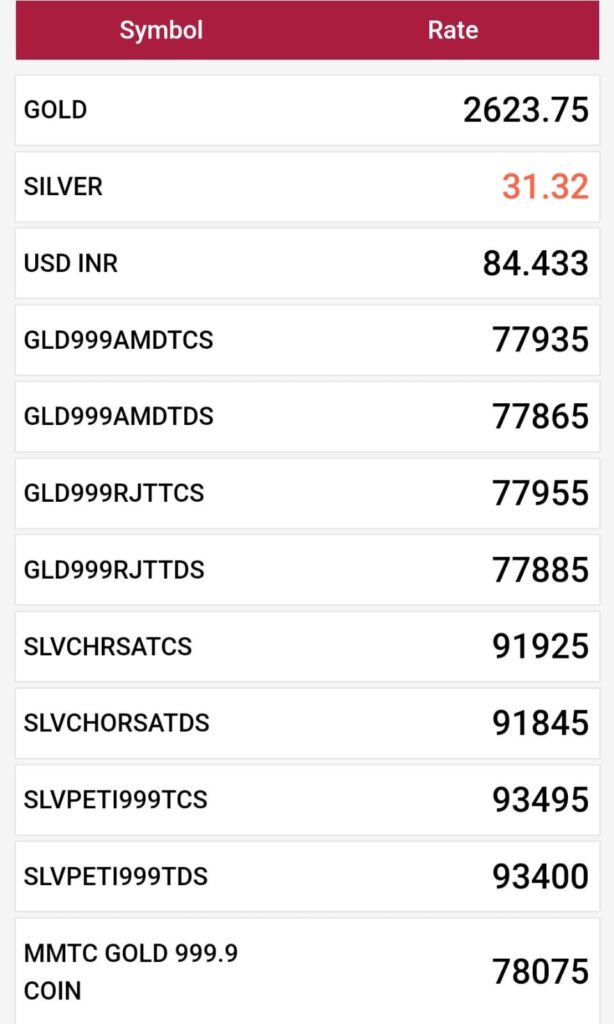

Websites like GoodReturns, MoneyControl, and GoldPriceIndia provide real-time gold rates for different cities. They often include both 22-karat and 24-karat prices.

દરરોજ ના સોનાના ભાવ અહિંથી જૂઓ

b) Mobile Apps

Gold rate tracking apps like Gold Price Live, Khatabook, and Paytm Gold allow users to monitor daily prices and set alerts for price changes.

c) Jewelers’ Websites

Renowned jewelry brands such as Tanishq, Kalyan Jewellers, and Malabar Gold update daily gold prices on their platforms. These rates often reflect the actual buying price, including making charges and taxes.

d) Financial News Channels

TV channels like CNBC TV18 and ET Now, along with financial news apps, frequently report gold price trends.

- Local Market Rates: Why They May Vary

Gold prices can slightly differ between cities due to transportation costs, local taxes, and jeweler-specific margins. To get city-specific prices, you can:

Visit local jeweler shops for daily updates.

Check regional websites or apps for city-wise pricing.

- Best Times to Buy Gold

While there’s no guaranteed “best time” to buy gold, keeping an eye on price drops and tracking trends over weeks or months can help you make an informed decision. Festivals like Akshaya Tritiya and Dhanteras often see discounts or promotions from jewelers, making them popular for purchases. - Tips for Checking Gold Prices

Cross-Verify: Compare rates across multiple sources before making a purchase.

Understand Purity Levels: Ensure you know whether the rate displayed is for 22K or 24K gold.

Account for Additional Costs: Final prices at jewelers may include making charges and taxes.

Monitor Trends: If you’re investing, consider gold price trends over weeks or months rather than daily fluctuations. - Future Outlook for Gold Prices

Gold has historically been a stable investment. With economic uncertainties and inflation, many Indians turn to gold for financial security. Staying informed about price trends can help you make the most of your investments or purchases.

Whether you’re buying for personal use or investment, regularly checking gold prices ensures you make smarter financial decisions. Bookmark your favorite sources, stay informed, and be prepared for the next great opportunity!

Let us know your favorite method for tracking gold prices in India in the comments!